25+ Btl how much can i borrow

Income and affordability criteria. Making a change.

Super Star Destroyer First Order Star Wars Pictures Star Wars Poster Art Star Wars Poster

You may see 95 mortgages described as 95 LTV.

. Buy to let guide. 5 steps to become a buy to let landlord. Where affordability is concerned some lenders insist on a minimum income requirement for a buy to let mortgage 25000 is standard especially if youre a first-time landlord.

If youre already a mortgage customer. It will not impact your credit score and takes less than 10 minutes. Most BTL mortgages are interest-only.

The top 25 locations for rental yield in the UK achieve between 699 and 1000. As most mortgages last for 25 years you would normally need to be 45 years old or younger to be. This means you pay the interest each month but not the capital amount.

An AIP is a personalised indication of how much you could borrow. How much can I borrow. Should I use a mortgage broker.

Reducing your household bills. The fees tend to be much higher. An AIP also shows estate agents that youre a serious.

A high fee is often worth paying in order to secure a low interest rate if you are applying. Ideal for landlords considering what BTL mortgage to choose our buy to let calculator helps you to calculate your rental yield. Most lenders will typically require you to receive 125 of your monthly interest payments in rental income but can sometimes be as high as 145.

This means that applicants need to be able to put down a deposit of 25-40 of the propertys value. Switch to Virgin Money 25 cashback up to 160 on your UK supermarket and fuel spend when you switch to us. If your next home also costs 200000 youll put down the 50000 deposit and get a residential mortgage to cover the remaining 150000.

This will give you a solid idea of how much you can borrow the type of rates you have access to and whether a lender will accept you at all. The amount you can borrow depends on how much rent you can realistically expect for your property. Interest rates on buy-to-let mortgages are usually higher.

Think carefully before securing other debts against your property. But the shorter your term the more. Around 25 deposit if you want to rent the property out Closer to 30 if you want to secure a holiday let mortgage.

Do bear in mind you should plan to pay your mortgage off before you reach your retirement age. Other lenders will accept borrowers with lower personal income but it is also possible to find a BTL provider that will impose no income requirements. The minimum deposit for a buy-to-let mortgage is usually 25 of the propertys value although it can vary between 20-40.

On a 250000 interest-only mortgage charging 3 over 25 years youd repay 625 a month equating to 187500 over the 25 years but would also have to pay back 250000 at the end of the deal. 425 Fixed to 30112027. How much could I borrow.

Your property may be repossessed if you do not keep up repayments on your mortgage. A let-to-buy lender with a minimum buy-to-let LTV of 75 might let you borrow 50000 from the property as a deposit to purchase your next home and convert your previous home to buy-to-let. This is the how long youd like to borrow the money for eg.

Source Totally Money Buy to Let Yield Map 201920. LTV is a percentage figure that reflects the amount of your property that is mortgaged. It means loan-to-value and is the percentage of the propertys value thats being covered by the mortgage.

Because you are charged an interest rate on your mortgage you will end up paying back more than you borrow so the less time you spend paying it off the less you will pay in total. Reverting to 424 Variable collared at 249 APRC. Buying a second home.

The best mortgage rate for you depends on how much you are looking to borrow. If your mor tgage is 200000 and your property is valued at 250000 your LTV is 80. For a buy to let mortgage most lenders will ask for a 25 deposit but this can vary some lenders may ask for a higher amount sometimes up to 40.

Youll need a minimum 25 deposit for a buy-to-let mortgage. You can speak to one of our mortgage advisers or apply online. How much can I borrow on a buy-to-let mortgage.

How much deposit do you need for BTL. Ways to borrow Debt Consolidation Loan See all loans. If you borrowed 250000 on a repayment mortgage with the same terms youd repay 1186 a month and would have cleared the capital after 25 yearsUnder these terms youd pay.

If you are shopping for a mortgage try out the Times Money Mentor comparison tool. 2 Year Fixed Rate ISAs.

Season 4 Rebels Gif By Star Wars Star Wars Star Wars Ships Star Wars Gif

Clone Wars Era Fighter Y Wing Star Wars Spaceships Star Wars Ships Design Star Wars Vehicles

Buy To Let Mortgage Advisers Mint Fs

Pin De Miqueas Mendez En Halo Armadura De Halo Vehiculos Futuristas Halo Fondos De Pantalla

Nubian Royal Starship Updated Ortho New Star Wars Spaceships Star Wars Ships Star Wars Vehicles

Pin On Ship Of My Dreams

Pin On Tattoo

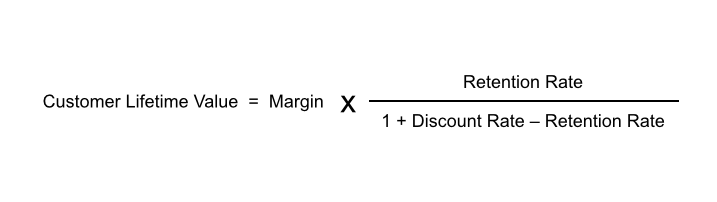

What You Should Know About Customer Lifetime Value Clv

Star Wars Concept Art Concept Art Gallery Star Wars

Pin On Star Wars

Btl B Y Wing Starfighter Star Wars Vehicles Star Wars Ships Star Wars Fanfiction

Pin On Star Wars Ships

Captain Rex Phase 2 Kris Jan Delport Star Wars Clone Wars Star Wars Jedi Clone Wars

Incom T 47 Snowspeeder Ortho New By Unusualsuspex Deviantart Com On Star Wars Ships Star Wars Vehicles Star Wars Rpg

Simply Buy To Let Mortgage Advisers Mint Fs

Incom Ut60d Star Wars Spaceships Star Wars Rpg Star Wars Ships

Rz 2 A Wing Starfighter Schematics 01 By Ravendeviant On Deviantart Star Wars Ships Star Wars Spaceships Starfighter